Private banking has always been about bespoke service, discretion, and long-standing personal relationships. Today, that excellence must extend into every digital interaction. A new standard is emerging, driven by the expectations of high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients who are used to premium service supported by digital excellence and ease.

Delivering on that expectation is where many private banks fall short. Legacy systems, operational inefficiencies, and outdated digital channels have created a disconnect between what clients experience in their daily digital lives and what they receive from their financial institutions.

How can private banking bridge that gap? This article explores what defines a premium digital experience, and how private banks can reimagine service delivery to retain relevance in an evolving market.

What defines modern white-glove service?

White-glove digital experiences go far beyond simple online banking. They embody personalised, frictionless engagement, where excellence is embedded into every interaction — whether digitally or in person.

A recent Capgemini study found that 55% of HNWIs consider digital capabilities a key factor when selecting their wealth management provider. They want freedom to access, monitor, and manage their wealth anytime, anywhere, and across any device. The expectation is real-time responsiveness with intuitive navigation, and interactions that feel as tailored as an in-person meeting.

Crucially, white-glove digital experiences are not about replacing the human touch. Rather, they enhance it. That is what a hybrid model is all about: moving between self-service and relationship-manager-assisted journeys. Human expertise must be available when needed, enhanced by technology that feels personal and immediate.

Key components of enabling digital white-glove service

Delivering a premium experience in private banking means combining elegance with utility. Every digital touchpoint must feel premium, intuitive, and deeply personal, built around the complex lives and expectations of HNW and UHNW clients.

Let us explore key capabilities that set leading private banks apart.

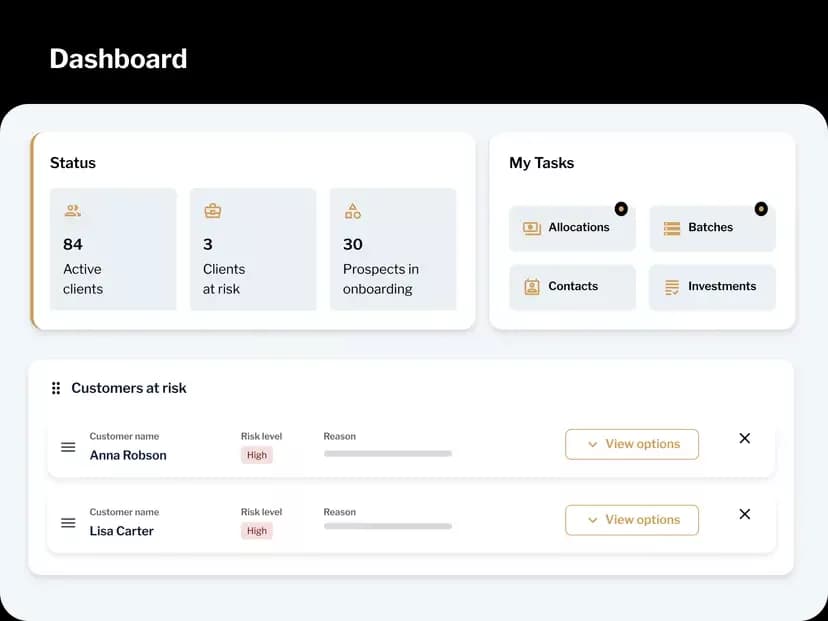

1. Personalised dashboards and comprehensive views

Clients expect more than basic account summaries; they look for dynamic, configurable dashboards that reflect their financial priorities. That means surfacing the most relevant insights and content based on who the client is and what they need at a given moment — whether that is recommended opportunities for those investing, performance analytics for an institutional portfolio, or an estate plan for the head of a multi-generational family.

Both clients and relationship managers should be able to personalise these views, curating what matters most. This “segment of one” approach elevates how information is delivered and discussed, enabling more relevant conversations and faster decisions.

2. Real time access and control

According to McKinsey, private banks plan to triple their technology spend, and for good reason. From executing trades to approving payments, today’s clients demand immediacy. High-net-worth clients often operate across time zones and need the flexibility to take action without delay. A premium experience includes the ability to initiate transactions, transfer funds, or adjust portfolios from a smartphone, without friction.

3. Support for complex needs

HNW and UHNW clients often manage multi-entity structures, including trusts, family offices, and private investment vehicles. They need digital tools designed to handle this complexity: multiple account holders, cross-border compliance, and multi-generational visibility. A unified, intuitive experience that brings all of this together — including a comprehensive view of total net worth — is a major differentiator.

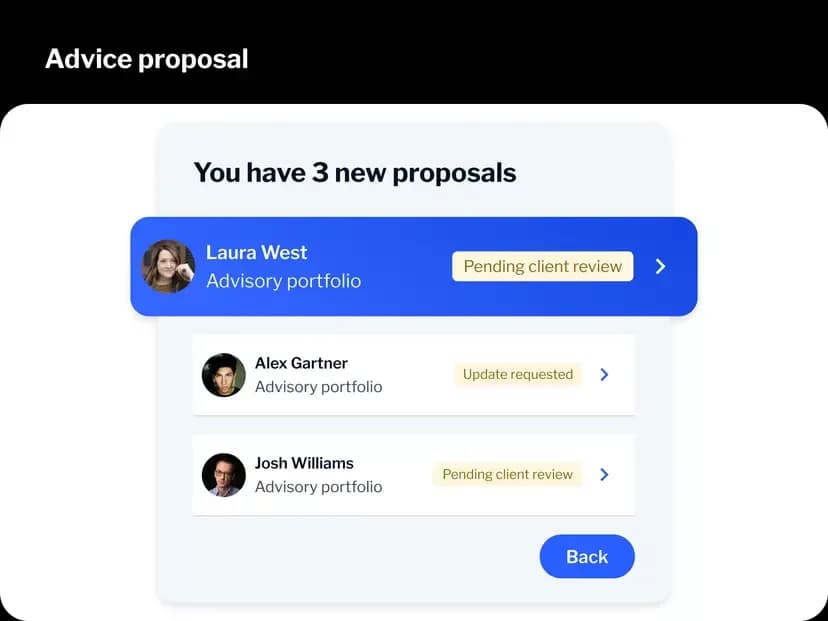

4. Easy collaboration

EY highlights that 85% of clients value personal advice when monitoring performance. They want the ability to engage with their RM via secure chat, video, or shared digital workspaces to ensure they have access to this advice whenever they want.

Approving an investment proposal or exchanging documents should feel as natural as sending a message in WhatsApp; true collaboration means both the client and RM can operate on a shared platform in real time. Delivering this level of service requires banks to integrate real-time communication tools, streamline workflows for advisers, and ensure data from various systems is available in a unified environment to support timely, well-informed interactions.

6. AI-powered advice and proactive nudges

AI-driven tools enable banks to deliver personalised product recommendations, investment nudges, and next-best actions that are timely, contextual, and relevant. For example, AI can analyse patterns in a client’s portfolio to identify concentration risks and suggest diversifying with alternative assets or lower-volatility instruments. Similarly, when a client initiates a large FX transfer or draws from a credit facility, the system can proactively surface tailored investment opportunities or lending products aligned to their profile.

By embedding these capabilities directly into the client experience, banks can offer advice that is always on, even outside of traditional advisery meetings.

Private banks are under pressure to adapt, but that does not mean radical disruption; it is about aligning timeless principles of service with modern expectations and tools. Modernising the white-glove service is a way to strengthen what private banks already do best, while addressing today’s operational and client-facing challenges. Here is why it matters.

Meeting new expectations

HNW and UHNW clients increasingly expect the same immediacy and elegance in their banking experience as they do from luxury apps and services. This means offering mobile-first journeys, personalised dashboards with holistic net worth views, and consistent access across devices. It is no longer sufficient to provide basic digital tools. The experience must be cohesive, premium, and built around the complex financial lives of wealthy individuals and families.

Supporting client retention and acquisition

Longstanding clients are evaluating their providers through a new lens, while new wealth creators — often entrepreneurs and digital natives — bring entirely different expectations. AI-powered nudges and tailored content, dynamic personalisation based on geography or relationship structure, and real-time collaboration features all help ensure the experience feels curated and meaningful.

When clients feel understood and supported, they stay. And when prospects see a digital experience that reflects their expectations, they take notice.

Empowering relationship managers

With fewer administrative tasks and better access to client insights, RMs can approach each interaction with greater context and confidence. Pre-meeting intelligence, real-time messaging, and digital co-working spaces make the advisery process more effective and responsive. Crucially, by reducing time spent on manual tasks, banks free up RM capacity to focus on delivering high-value, personalised advice — not just service.

Lowering cost to serve

White-glove digital services also contribute to a lower cost-to-serve model. Rather than relying solely on human interaction for every task, clients are empowered to self-serve for common activities such as onboarding, document uploads, and payment execution. At the same time, automated workflows reduce internal burdens. This allows banks to maintain a premium service model while gaining operational efficiencies.

Enabling the transformation of your private banking model

Delivering premium digital experiences is the key to sustaining relevance, capturing the next generation of wealth, and building deeper, longer-lasting client relationships.

Achieving this vision requires a modern, flexible platform capable of delivering unified, personalised journeys across the entire client lifecycle.

Backbase offers an AI-powered Banking Platform with out-of-the-box modules tailored for private banking, allowing banks to create unique, white-glove digital experiences that reflect their brand and values while addressing the evolving needs of HNW and UHNW clients. Built to simplify operations and scale personalisation, it is how private banks stay relevant and grow.

Read more about Backbase for private banking >

Read the original article here.