Clockwork

HQ Address

609 E Market, Suite 107, Charlottesville, VA 22903, United States

Website Address

Relevant Regions

Business introduction

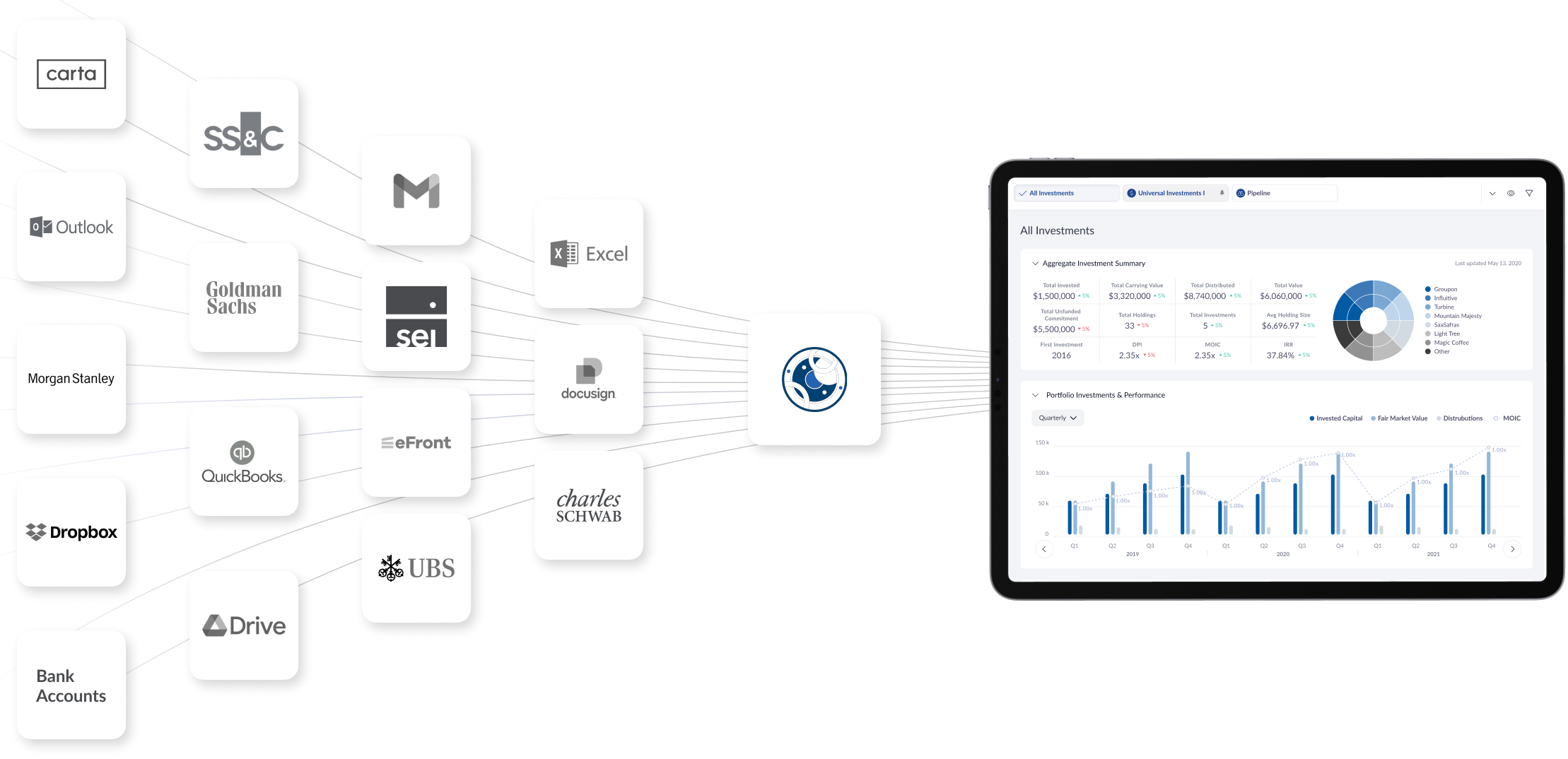

Manage your alternative investments, and everything else, with Clockwork. Our technology and team integrate investment content, emails, documents, and transaction data from siloed sources, centralized in one place

Alternative investments are a must for the modern investor’s asset allocation. While often a complex and opaque space, Clockwork helps investors navigate the chaos and make better investment decisions

Clockwork’s private investment management platform powers investors to centrally track alternatives and everything else. Our technology plus team approach integrates investment content, email and documents alongside transaction data and siloed private information sources. With a focus on private alternatives as the most challenging investments to monitor, we cover all asset classes to address a large, growing need in global capital markets. Today, Clockwork provides investors with real-time, consolidated views of $6.5 billion+ of invested portfolio value across 11,000+ investments and 80,000+ transactions.

Clockwork: the digital investment office for private investors

19/12/2025

Business Overview

Clockwork is building the digital investment office for private investors. We unite technology, expertise, and access — bringing your data, your team, and your investments together in one digital environment.

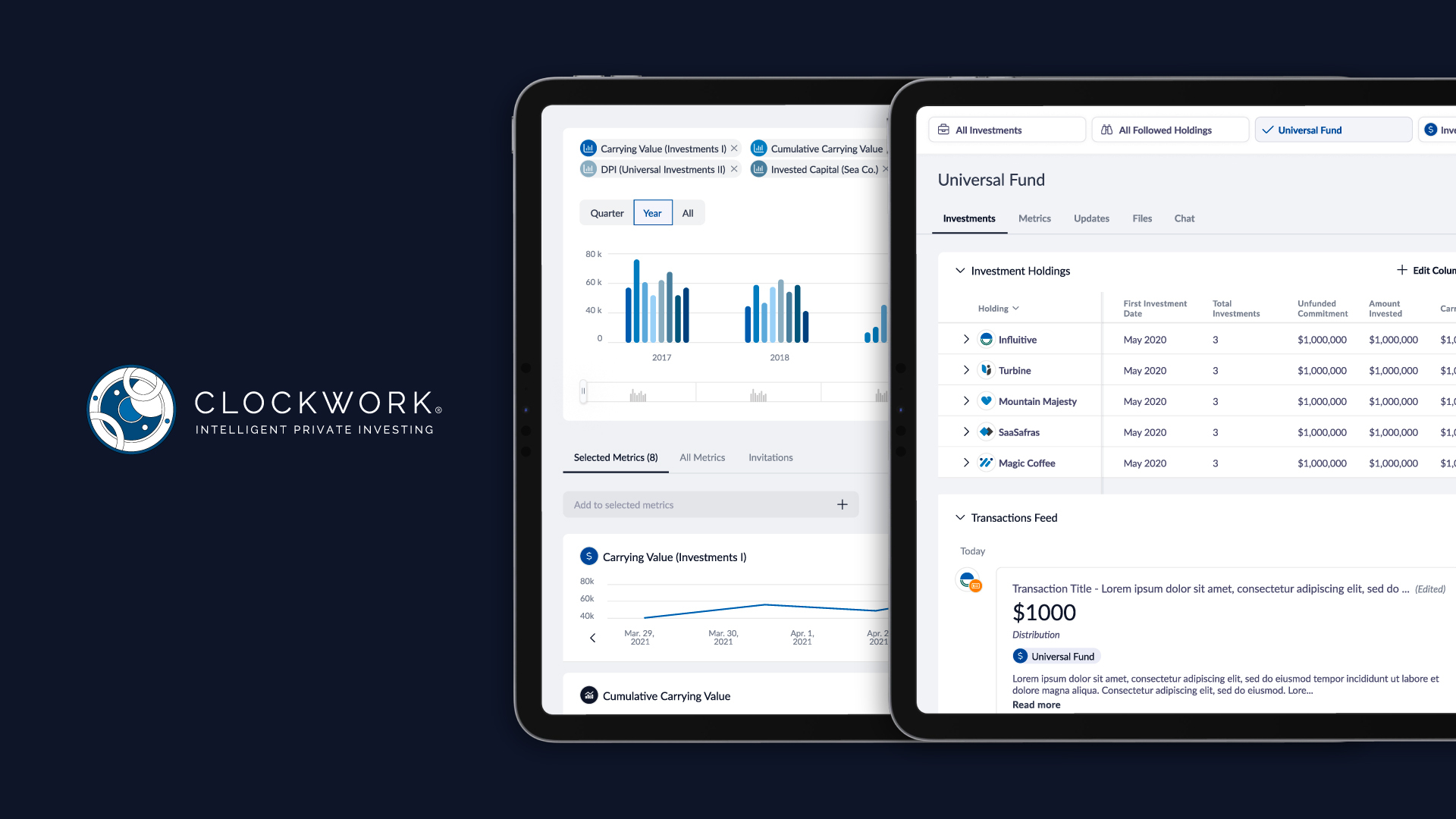

The Platform

At the core is the Clockwork platform, a centralized system of record for all assets. It provides a unified view across private funds, direct investments, operating companies, real estate, and other alternative exposures, alongside public market holdings. By consolidating fragmented data into a single, continuously updated environment, the platform enables better visibility, cleaner reporting, and more informed decision making.

Fractional Analyst Teams

Layered on top is our Investment Solutions offering, designed to function as an extension of your internal team. We support clients across due diligence, portfolio construction, performance analysis, cash flow planning, governance, and ongoing oversight. We provide consistent analytical capacity and institutional discipline where it is most needed, without the cost or rigidity of building a full in-house team.

Private Investments

Access curated opportunities in private markets

Clockwork connects investors to high-quality private equity, venture, and alternative opportunities through our trusted network of managers and partners. This includes direct investments, co investments, and thematic strategies built around long-term value creation.

Customers

Clockwork’s clients are asset owners, including high net worth individuals and family offices, with meaningful exposure to private and alternative investments. They operate across complex portfolios that span asset classes, vehicles, and jurisdictions, where visibility and coordination are often fragmented. These clients value centralized oversight, timely insight, and a structured approach to portfolio management.

Broadly, Clockwork serves two client profiles. The first consists of asset owners primarily invested in private alternatives, with portfolios ranging from several hundred thousand to a few million dollars. The second includes larger asset owners managing tens to hundreds of millions of dollars, requiring a consolidated view across both private and public investments.

Partners

Clockwork partners with select operators, advisors, and platforms across the private markets ecosystem, collaborating on thought leadership initiatives and referral relationships that create mutual value and better outcomes for shared clients.

Key Data

Year founded

2016employees

11-50offices

3Type of Clients

- Asset Managers

- Digital Wealth Manager

- Family Offices

- Financial Advisors

Clockwork Solutions

Clockwork Universe Platform

Our platform centralizes every element of investment management, data, documents, communications, and performance, in one secure, connected environment. Built for asset owners, family offices, and investment professionals, Clockwork helps users monitor complex portfolios with clarity and confidence. From private equity and venture capital to real estate, credit, public markets, and collectibles,......

business needs

- Data Management & Analysis

- Digital Platforms & Tools

- Investment Platforms & Tools

- Portfolio Build, Analysis & Reporting

- Portfolio & Wealth Management Systems

Client type

client geography presence

view solutionInvestment Solutions Team

Clockwork’s Investment Solutions combine institutional expertise with the technology of the Clockwork platform to help investors manage complexity with clarity and confidence. Built for asset owners, family offices, and investment professionals, our solutions address every stage of the private investment lifecycle, from diligence to governance, operations, and reporting. Each engagement is......

business needs

- Investment Platforms & Tools

- Portfolio Build, Analysis & Reporting

- Portfolio & Wealth Management Systems

Private Investments

Clockwork Investments provides qualified investors with selective access to proprietary opportunities across private markets. Rooted in the same platform that powers data, diligence, and reporting for $6B+ in monitored assets, this initiative extends Clockwork’s mission from monitoring capital to deploying it intelligently. Our team sources, evaluates, and manages direct and fund......

business needs

- Investment Platforms & Tools

- Portfolio Build, Analysis & Reporting

- Portfolio & Wealth Management Systems