Solution introduction

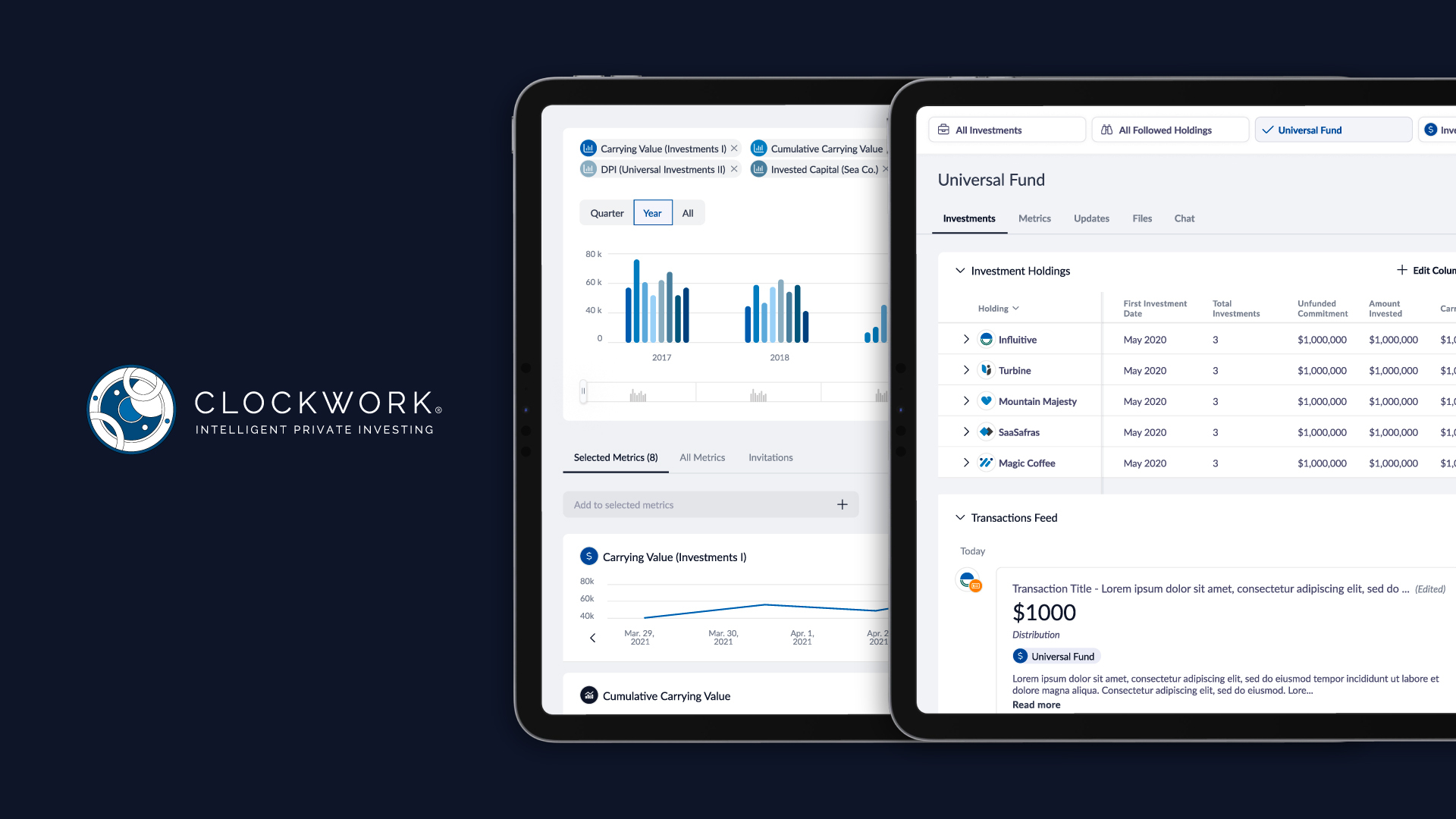

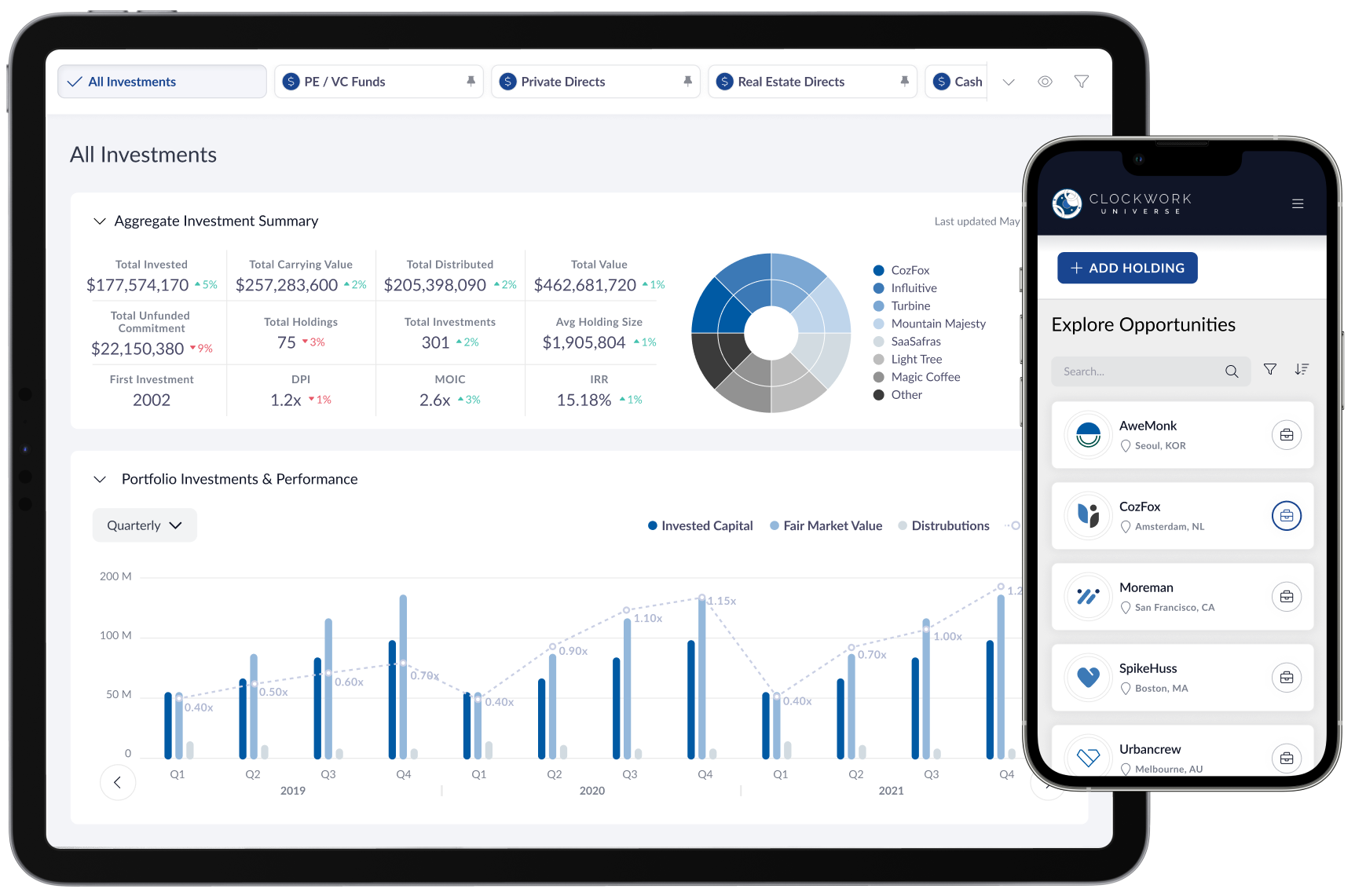

Our platform customized for you. Centralize your investment data, documents, and communications in one place. Track performance, manage transactions, and collaborate securely across teams and entities

Your single source of truth for private investments. We offer a variety of features that will help increase your productivity and simplify your private investment management

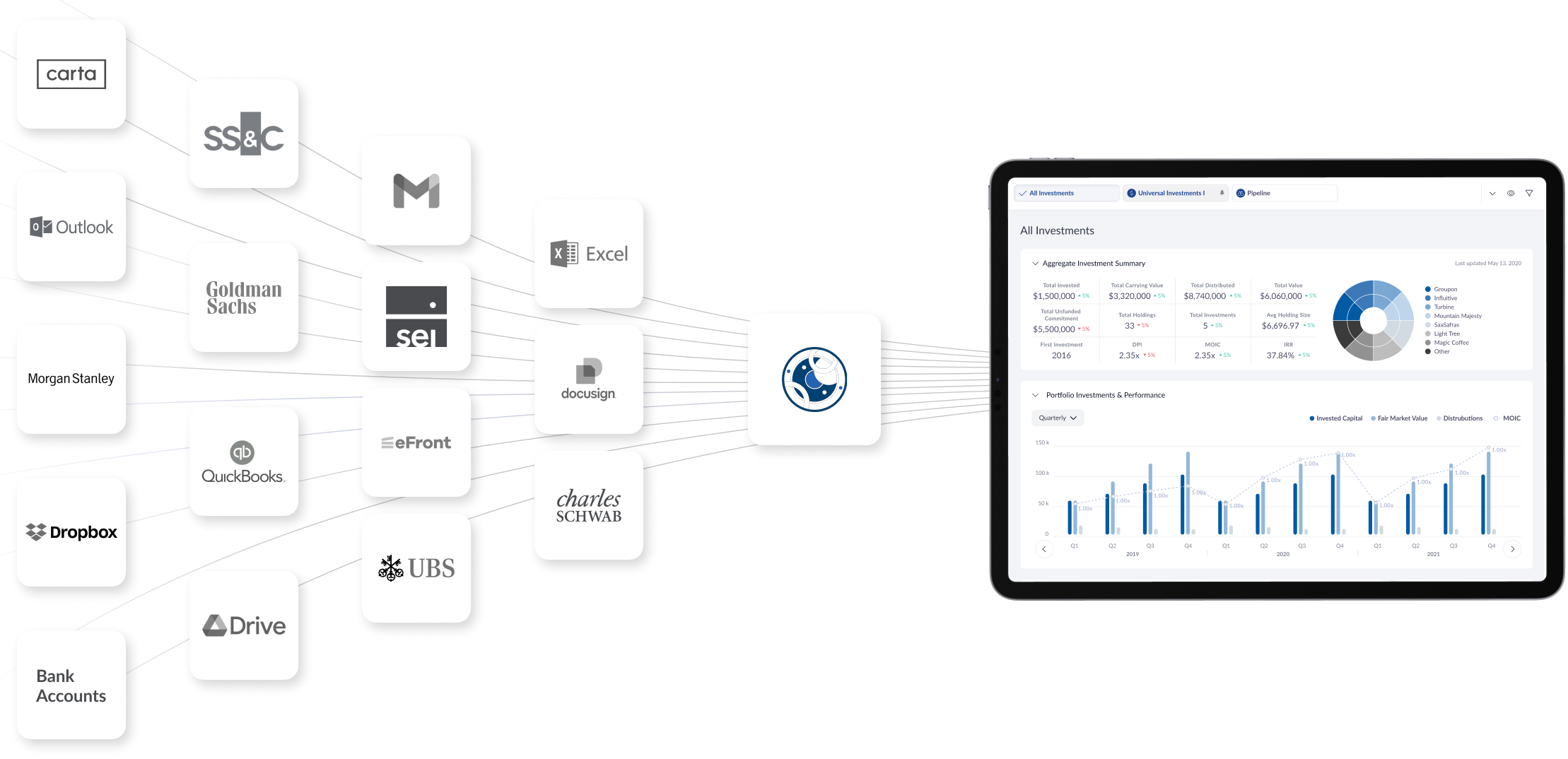

Our platform centralizes every element of investment management, data, documents, communications, and performance, in one secure, connected environment.

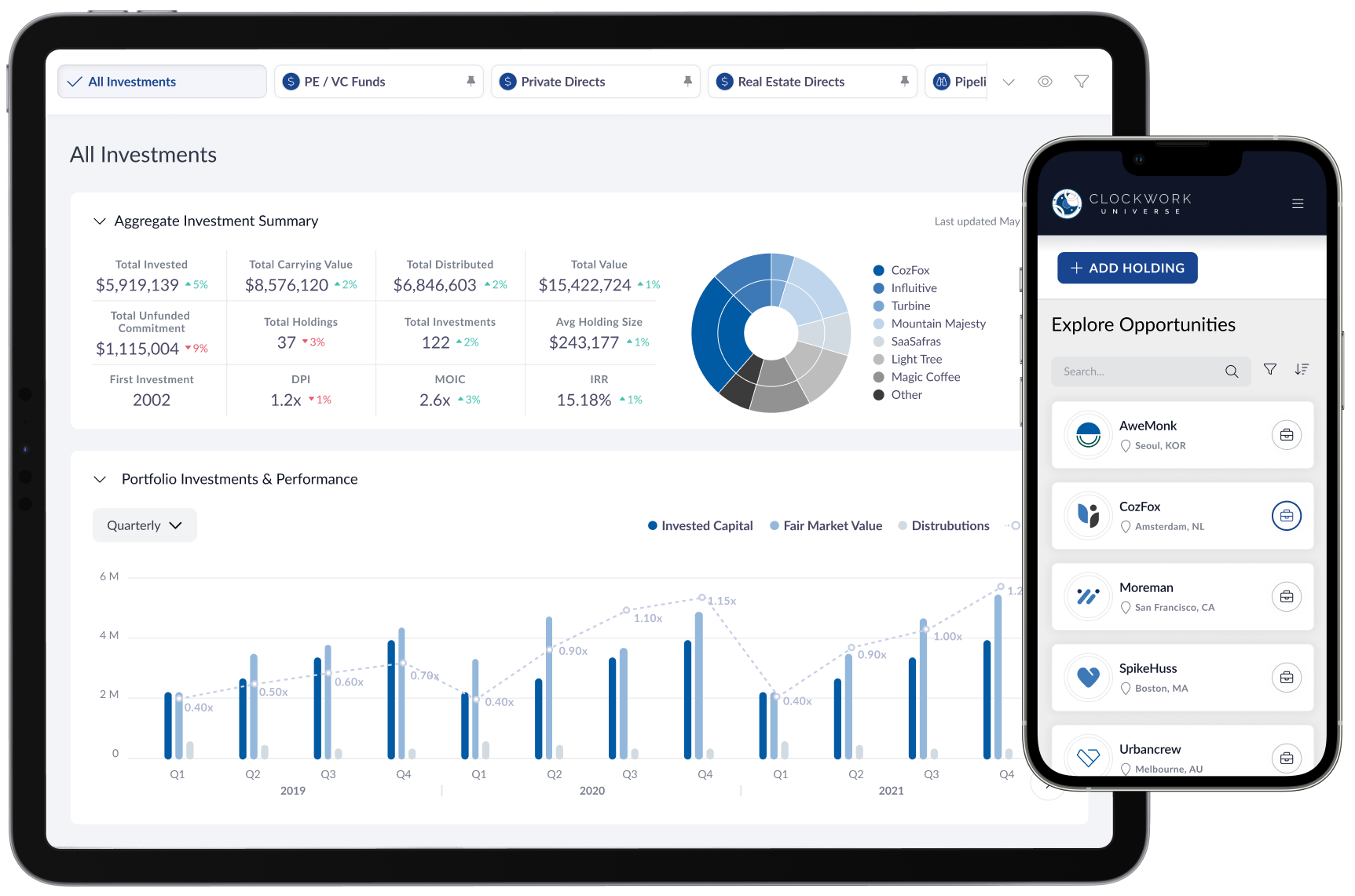

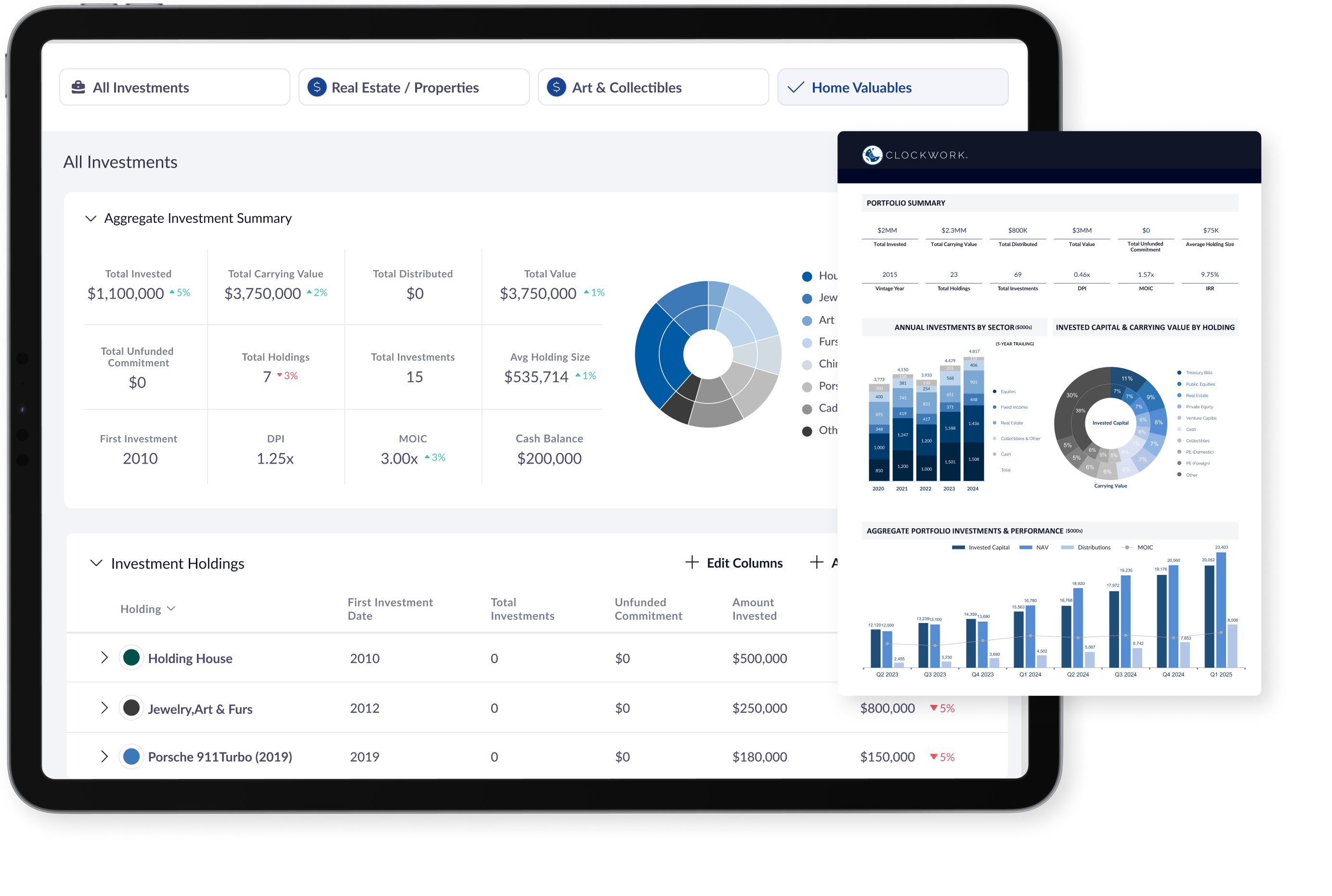

Built for asset owners, family offices, and investment professionals, Clockwork helps users monitor complex portfolios with clarity and confidence. From private equity and venture capital to real estate, credit, public markets, and collectibles, all holdings can be tracked and valued in a single, unified view.

Clockwork automatically ingests and reconciles investment data, transforming fragmented reports, statements, and emails into structured, actionable insights. Documents are intelligently organized and linked to the relevant entities, transactions, and metrics, ensuring information is always contextualized and easy to retrieve.

Collaboration is built into the experience. Teams, advisors, and stakeholders can securely share updates, upload materials, and maintain a transparent record of activity across entities, without relying on disconnected spreadsheets or inbox threads.

Clockwork: the digital investment office for private investors

Features

Clockwork is designed to bring precision, structure, and visibility to private and public market portfolios. Built for asset owners, family offices, and advisors, the platform supports the full investment lifecycle, from opportunity tracking to long term portfolio oversight, while centralizing the data, documents, and workflows that private investing demands.

Investment Management

Clockwork provides accurate, granular control over private investments and broader portfolios. A centralized portfolio dashboard offers a unified view of active holdings, pipeline investments, and historical activity, updated dynamically as new information becomes available. Users can monitor performance across portfolios, individual investments, and transactions, enabling consistent measurement despite differing structures, vintages, and asset types.

Transaction level tracking allows investors to organize capital calls, distributions, valuations, and ownership changes with clarity. For families and institutions managing multiple stakeholders, member management tools enable individualized access and permissions, ensuring the right information reaches the right parties without compromising confidentiality.

Files and Content Management

Private market investing generates extensive documentation. Clockwork centralizes investment related files, communications, and records in a secure environment designed for long term ownership. Advanced data collection and indexing make documents searchable and analyzable, reducing reliance on spreadsheets, inboxes, and disconnected storage systems.

Automated email digests and alerts keep users informed of updates, upcoming actions, and portfolio activity without requiring constant manual review. Reporting outputs transform raw data and documents into usable insights, supporting both internal decision making and external communication with advisors, partners, and stakeholders.

New Opportunities and Pipeline Management

Clockwork supports disciplined deal flow management through structured opportunity tracking. Investment profiles allow users to store files, notes, and key data points for prospective investments, with custom tagging for efficient comparison and filtering. An opportunities pipeline provides a clear view of current and future considerations, helping investors move from ad hoc sourcing to a more deliberate process.

Collaboration tools make it easy to explore and share opportunities within co investor networks, expanding inbound deal flow while maintaining organization and context. This approach supports thoughtful evaluation without sacrificing flexibility.

Metrics and Portfolio Intelligence

Clockwork enables users to define and track custom metrics at the investment level, accommodating different strategies, structures, and objectives. Portfolio level metrics provide a holistic view across holdings, allowing investors to identify trends, concentration risks, and performance drivers.

Milestones and goal tracking help monitor progress over time, particularly for operating companies and long duration investments where value creation unfolds gradually.

Investor and Stakeholder Management

For advisors and managers, Clockwork facilitates ongoing engagement across multiple vehicles and client relationships. Permission based reporting, branded portals, and activity tracking allow information to be shared professionally and securely. Communications, commitments, and reporting are organized in one place, supporting transparency and trust at scale.

Benefits

Clockwork delivers a structured, institutional approach to managing private market portfolios, addressing the core challenges of visibility, coordination, and control. By centralizing data, documents, and workflows, the platform replaces fragmented tools with a single source of truth across private and public assets.

The primary benefit is clarity. Investors gain a unified, continuously updated view of their portfolios, including holdings, pipelines, and historical activity. Performance can be assessed consistently across asset classes, structures, and vintages, enabling more informed decision making and better oversight of long-term capital.

Clockwork also improves operational efficiency. Transaction level tracking, automated updates, and centralized file management reduce manual processes and reliance on spreadsheets and email. Information is organized, searchable, and accessible, allowing teams to spend less time compiling data and more time evaluating risk, performance, and opportunity.

For complex ownership structures, the platform supports disciplined collaboration. Role based access ensures the right stakeholders have appropriate visibility, while shared dashboards and reporting align internal teams, advisors, and family members around a common view of the portfolio.

The platform is purpose built for private markets, where opacity, irregular cash flows, and long investment horizons demand greater rigor. At the same time, integrations with traditional accounts provide a consolidated perspective across the full balance sheet, without diluting focus on the assets that require the most attention.

Ultimately, Clockwork enables investors to move from reactive portfolio management to a repeatable, deliberate process. The result is better governance, improved decision quality, and greater confidence in managing private capital across cycles and generations.

Key Data

Type of Clients

- Asset Managers

- Family Offices

- Financial Advisors

Client Regional Presence

- North America

- South America

- Western Europe

Clockwork Universe Platform

Please click the button below to connect with Clockwork