Solution introduction

Never miss a notice date

Today, investment firms must have robust liquidity management tools and procedures. However, too often fund of funds, endowments, pensions and institutional investors continue to grapple with liquidity management and reporting within their investment portfolios due to a range of issues including complex structures, side pocket interests, gating complexities and regulations.

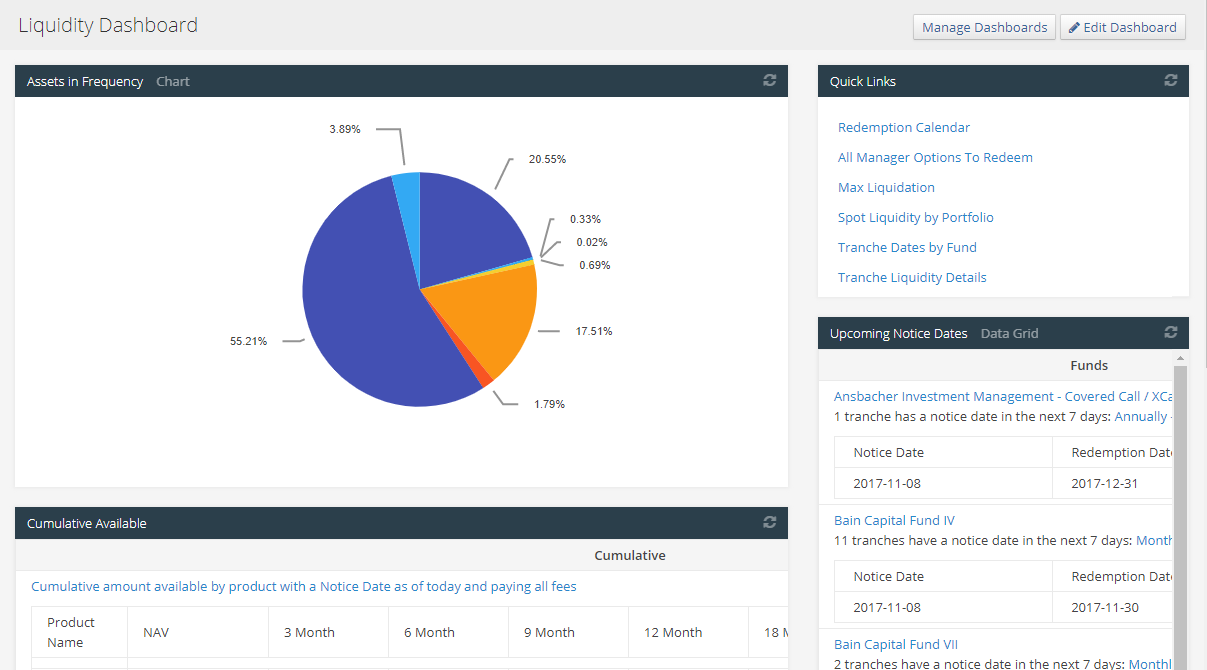

Ledgex Liquidity solves this by providing an advanced liquidity modeling utility and reporting engine. The Ledgex Liquidity engine generates all available options for accessing assets given certain conditions by processing each tranche and their respective trade characteristics with a manager’s liquidity terms. The platform also enables modeling and analysis of a portfolio or manager’s liquidity through various configurable reports and utilities, including liquidity calendars, liquidation scenarios and portfolio projections.

Ledgex Liquidity features:

- Regular and irregular frequency

- Client defined custom frequency builder

- Notice and custodian notice day calculator

- Hard and soft locks

- Purchase liquidity options

- Investor level gates with stacking gate support

- Fund level gates

- Liquidity alerts

- Liquidation scenario modeling