To tap the rising demand for investment, insurance and other wealth management services among the growing numbers of mass affluent in South-east Asia, incumbent banks must find new ways to bridge the digital delivery gap as they adapt to a changing landscape and compete with the agility and pioneering nature of Super Apps.

How to deliver digital wealth to the mass affluent

- The rapid growth in the mass affluent population in South-east Asia from 57 million, at late-2018, to 136 million by 2030 is reshaping demand for how financial services are delivered and used.

- Many incumbent banks struggle to roll out superior digital servicesto meet the emerging and evolving investment, insurance, lending and other wealth management-related needs of the increasingly young and digitally savvy consumers in the target wealth segment. The banks are hampered by legacy IT systems as well as a thin talent bench in areas such as software development, digital marketing and data science.

- The shifting landscape is seeing Super Apps — like Grab, Gojek, Alipay, PayTM and WeChat, among others — tap the demand of the mass affluent in Indonesia, the Philippines, Thailand and Vietnam. They are leveraging an existing and loyal customer base using their agility and understanding of their target audience.

- The way forward for incumbent banks is to identify ways to embed financial products and services across multiple channels, and to understand how to collaborate effectively with multiple third parties and systems.

- The ultimate goals for the banks include: increasing business volume; activating underserved clients; broadening sales activity into areas such as life insurance; and producing at zero marginal costs.

- The five key components of success for banks that want to deliver a more relevant wealth services for the mass affluent across Indonesia, the Philippines, Thailand and Vietnam are: creating partnerships and ecosystems; developing open data and APIs; enhancing data and analytics capabilities; keeping the offering simple; and taking a gradual, step-by-step approach.

- The future will likely involve some form of power shift between incumbent banks and tech firms that drive the Super Apps. Ultimately, banks will have to cede ground as pioneers of financial innovation in the past but in partnership with payment gateways, transaction and trading platforms, investment tools and other mobile functionality that enhances the user experience.

Section 1: A SHIFTING LANDSCAPE AND MIND-SET

South-east Asian wealth surge brings new wave of consumer

The rapid growth in the size of the mass affluent segment across the region is reshaping demand for how financial services are delivered and used

The large and fast-growing mass affluent population in South-east Asia provides a mouth-watering pool of new consumers for all industry sectors. However, it remains under-tapped by many traditional financial services firms that continue to grapple with how to meet the emerging and evolving investment, insurance, lending and other wealth management-related needs of this segment.

It is difficult to imagine many banks or insurance companies wanting to let this be the case for much longer.

Some headline statistics from several reports explain why the region is so enticing — including a late 2018 Boston Consulting Group (BCG) survey of roughly 6,000 affluent consumers in six major South-east Asian countries, and the annual study by Google, Temasek and Bain & Company, the latest of which was released in October 2019:

- The region’s affluent will grow in size from 57 million as of late-2018 to 136 million by 2030

- Nearly two-thirds are under 40 years of age, with three-quarters of them advancing from the middle class over the past 10 years

- The affluent are more digitally engaged than other income segments — 59% of affluent Thais and 88% of Filipinos, for example, actively use digital channels during the shopping process

- 90% of the 360 million internet users in South-east Asia connect primarily through their mobile phones

- In Indonesia, the Philippines and Thailand, the mass affluent population accounts for between 45% and 65% of household wealth

Given such numbers, it isn’t surprising that all types of businesses from unicorns to small start-ups to traditional financial institutions are striving to create and leverage digital tools to tap the financial services needs of this expanding market of customers.

Yet unlike a decade or so ago, it is no longer the case that wealth management arms of the traditional retail banks automatically capture the lion’s share. Targeted advertising and marketing gimmicks to lure affluent segments to buy ‘new’ products and services no longer go unchallenged. Banks that could previously rely on there being no viable alternative for how the newly-wealthy could save, invest, borrow, insure and manage wealth, have had a wake-up call.

The story today in Indonesia, the Philippines, Thailand and Vietnam, for example, makes interesting reading.

The mass affluent population in these four countries mostly consists of young professionals who are digitally savvy and seek exclusivity in their brands of choice, so says the BCG research.

They are already avid consumers of higher-end goods, accounting for roughly half of all spending in categories such as leisure travel, watches and cars across the region.

Further, with affluence coming (for most of them) over the last 10 years, they are increasingly ‘upgrading’ their purchases. They progress, for example, from having a scooter to a car, from owning a single white good like a refrigerator to having multiple home appliances, and from buying new clothes in department stores to shopping in boutique outlets.

Alongside more disposable income, financial goals — like saving, insurance and investing — have become a reality, so are in demand. And to achieve them, these mostly digital natives need financial education and guidance.

Putting into perspective the digital opportunity in South-east Asia, the Google, Temasek and Bain & Company report said the internet economy across Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam had crossed the US$100 billion mark for the first time. This was a rise of 39% on the $72 billion last year.

Digital payments, as one example, is set to grow from US$600 billion in 2019 to more than US$1 trillion by 2025.

Being able to access these and other new possibilities has given the mass affluent segment the option to ‘shop around’, in turn breeding a willingness to try new things as far as services go.

A separate report from Bain & Company released in May 2019 showed just how receptive consumers are to new ideas and players when it comes to insurance. In Thailand, Indonesia, mainland China and Malaysia, for example, the survey said more than 85% were open to buying policies from new entrants.

Source: “Beyond the “Crazy Rich”: The Mass Affluent of Southeast Asia,” Boston Consulting Group (November 2018)

The upshot of all these trends and new purchase habits of the mass affluent in South-east Asia are challenges and disruptive forces across key growth markets. After all, the financial services landscape has developed unevenly with various types of players targeting the emerging wealthy.

The key issue for incumbent local and regional banks, in particular, is that despite them having the most experience within financial services, the Google, Temasek and Bain & Company report says that “most of them struggle to roll out superior digital services, hampered by legacy IT systems as well as a thin talent bench in areas that matter the most, such as software development, digital marketing and data science”.

For the time being, therefore, the shifting landscape has paved the way for a variety of so-called ‘Super Apps’ to win the hearts and minds of the mass affluent in Indonesia, the Philippines, Thailand and Vietnam. The banks need to play catch-up, and quickly.

A fragmented financial landscape

A variety of players are looking to stake a greater claim to the financial services potential of South-east Asia.

Beyond traditional institutions in this space — such as banks, remittance companies and insurance companies, for instance — firms from ride-hailing companies and social media platforms to airlines and telecoms providers are all part of the ecosystem. The report by Google, Temasek and Bain & Company classified them broadly into four main buckets: pure play fintechs, consumer technology platforms, established consumer players and traditional financial services players.

Section 2: DISRUPTIVE PLAYERS CARVE A NICHE

The threat from within

Trusted digital disruptors are well-placed to tap the growing need of the region’s mass affluent for investment, saving, lending and other wealth management serves

As household names now across South-east Asia, Super Apps like Grab, Gojek, Alipay, PayTM and WeChat, among others, are quickly eyeing the potential for offering financial solutions, too, to the growing mass affluent population .

These brands, coupled with the products and services they offer, are already embedded in the daily lives of their target audience. When these consumers think about ordering a taxi, buying movie tickets, getting a meal delivered, booking a holiday, or doing countless other tasks, they turn immediately to their mobile device.

Defining the new generation

Super Apps– essentially portals, or digital hubs, to a wide variety of virtual products and services. Through a single sign-in, these providers often bundle online messaging, social media, marketplaces and access to retail services like taxis, travel, food and clothing, all as part of a streamlined user experience.

Indeed, South-east Asia’s increasingly engaged internet users are shaping technology trends. For example, over 150 million people in this region are now buying what they need online; the sector is valued at US$38 billion today compared with US$5.5 billion in 2015, and is on track to hit US$150 billion by 2025, according to the report by Google, Temasek and Bain & Company.

With such an established customer base which transacts online in multiple ways, the Super Apps seem well-positioned to offer financial services such as lending, investment and insurance.

Specifically, several key factors put disruptors in pole position to reshape the wealth management landscape for the mass affluent in South-east Asia:

- They already serve a large number of the new mass affluent population

- They have the tech talent to develop products and services in response to market demand as it emerges

- They are versatile and agile, so can adapt and evolve quickly to enter new industry sectors or geographies if needed

- They have the balance sheet to fund research and development, and to expand

- They have already developed an engaging user experience with which consumers are familiar

- They are already shifting their focus towards driving a higher engagement with existing users, not just acquiring new customers

A growing number of Super Apps have been quick to capitalise on this potential. They are already leapfrogging traditional institutions with more integrated and customer-friendly financial models.

In March 2019, for example, Grab Financial, a unit of South-east Asian ride-hailing giant Grab, rolled out several financial services across the region. These included an online checkout system that would let sellers accept Grab’s digital payment service. Grab also received a nanofinance licence from the Bank of Thailand, based on the company’s plans to make the most of the opportunity to increase financial inclusion among poorer Thais who lack access to traditional financial markets.

Line Corporation, meanwhile, has been leveraging the 44 million-plus users of its messaging app in Thailand via a range of new financial services. In 2018, for example, Line launched its own cryptocurrency, Link, releasing 1 billion tokens on the Bitbox digital asset exchange.

In some markets, it is simply geography that makes some traditional financial services operations increasingly redundant. Indonesia is such an example. This has enabled fintech firms and Super Apps to quickly gain a foothold, especially in the digital wallet and peer-to-peer lending segments.

Fintechs and Super Apps can also pose a credible threat to banks in the region.

There has been steady growth in digital payments, in particular, with total transaction value at US$8.5 billion as of September 2019, and expected to show an annual growth rate (CAGR 2019–2023) of 12.7%, resulting in the total amount of US$13.7 billion by 2023, according to a Statista market forecast.

Insurers are also feeling the threat from new types of players. Throughout the region, incumbents looking to expand are finding they have to contend with a distribution landscape being upended by advances in technology and the rise of digital-first competitors.

For example, fast-growth markets for insurance like Indonesia have seen insurtechs and other new entrants, including retailers and other companies from outside the industry, make strides in gaining market share.

Of the nearly 400 million adults in South-east Asia, the report from Google, Temasek and Bain & Company said that only 104 million are fully ‘banked’ and enjoy full access to financial services. Another 98 million are ‘underbanked’, with a bank account but insufficient access to credit, investment and insurance.

Source: “e-Conomy SEA 2019 — Swipe up and to the right: Southeast Asia’s $100 billion Internet economy”, Google, Temasek and Bain & Company (October 2019)

In short, Super Apps are impacting the traditional finance sector in three key ways:

- Disintermediating banks — by offering a range of basic banking, savings, insurance and investment products to their own customers. These are generally originated and underwritten by traditional financial institutions for now, but the customer experience and relationship will be entrenched with the Super App.

- Leveraging data to enhance services– by knowing how to effectively analyse the unprecedented amount of customer data they have acquired, to improve what they deliver and how they do this. For example, social media and transactional data can help to assess risks for loan applicants or tailor financial products to suitable customers — and offer it at the point when they need them.

- Building trust and a positive reputation– by incorporating easy-to-use payment mechanisms within an app, they don’t give users any reason to think about needing their bank or another provider.

Trust is also now much less of a hurdle than it was in the early days of online banking.

In fact, trust in tech firms entering the financial sector is not only strong, but also quickly closing the gap with traditional banks in Asia Pacific. According to Forrester, the research firm, 77% of consumers in the region already prefer to access their banking services via digital channels.

The research also found a preference towards engaging with firms that prioritise helping them improve their financial well-being.

Further supporting the ambition of the Super Apps is the fact that, according to BCG’s research, the frequent travel and social media usage of South-east Asia’s mass affluent consumers has led to a remarkably high proportion of them sharing similar values and preferences, regardless of language, culture and distance.

This makes the segment a much more accessible market than many companies might otherwise have thought previously.

A single regional strategy can therefore be effective, as even though many mass affluent consumers might not yet automatically think of buying financial products via a Super App, they quickly see and get familiar with the proposition, not to mention the convenience and simplicity on offer.

Section 3: A WAKE-UP CALL FOR INCUMBENTS

Not too late for banks to re-focus

Local incumbents and foreign challenger banks must adapt to seize the new opportunities by giving South-east Asia’s mass affluent more of what they want

It is clear that traditional financial institutions have been slow to respond and adapt to changing habits among the growing number of emerging wealthy across South-east Asia.

Yet if industries from music to media and from retail commerce to transport have evolved and gone through such a transformation, incumbent banks can learn how to do this, too.

This requires them to first fully understand the current banking pain points in the mass affluent segment. These generally include:

- Forms and the paper-heavy experience

- Lack of personalised investment ideas

- Expensive products

- Bad user experiences

- Minimal proactive service

- Limited reporting — or at least not user-friendly

- Branch-focused servicing

- Slow response times

- High cost of advice

- No 360-degree view of customers

Perhaps most importantly, the banks have no choice — they must change the way they do business to survive in the face of the challenges that confront them today. Just think of the mind-set of any customer — when they want to buy anything, their first reference is to go mobile, or at least online.

Against this backdrop, proprietary banking channels seem flawed in today’s environment.

Making this even more pressing is the fact that financial advice is becoming a core service for disruptors.

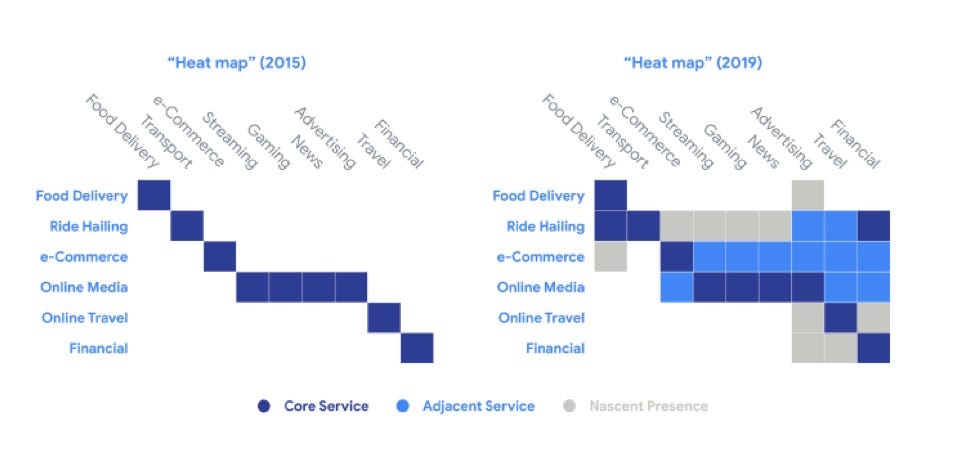

In a ‘heat map’ from the Google, Temasek and Bain & Company report, it is clear to see that different companies in various sectors of the internet economy have expanded their offerings into multiple business lines since 2015.

This heightened level of competition has given users flexibility to compare offers and select the best deals while the Super Apps have been able to acquire new customers and building consumer trust in their brands.

Source: “e-Conomy SEA 2019 — Swipe up and to the right: Southeast Asia’s $100 billion Internet economy”, Google, Temasek and Bain & Company (October 2019)

Source: “e-Conomy SEA 2019 — Swipe up and to the right: Southeast Asia’s $100 billion Internet economy”, Google, Temasek and Bain & Company (October 2019)

For the banks, competing in this way is easier said than done. It requires local incumbents to build a compelling case for offering clients financial advice that is supported by various mobile tools enhanced by artificial intelligence and machine learning.

Their goals must also include better portfolio recommendations coupled with improved access to reporting, in real-time.

These are all essential elements of delivering services in ways that appeal to the mass affluent population in South-east Asia.

As a result, the way forward for the incumbents is to identify ways to embed banking products and services across multiple channels, and to understand where they can be combined with data, as well as services, from multiple other parties and systems.

This is a key goal since the option of a separate brand that deploys a single-app channel strategy seems outdated in comparison with an ecosystem that blends a number of best-in-class apps, is lightly integrated and can be upgraded as a newer or better version appears.

At the same time, it isn’t all plain-sailing for the disruptors. For some of the independent fintechs, for instance, such as Momo (the Vietnamese payments app), Stashaway (the digital wealth management service) and Akulaku (the Indonesian digital lender), their business model or technology that is designed to tackle a pain point in terms of access, convenience, value and transparency, also incurs a high customer acquisition cost.

In short, the opportunity for traditional institutions exists in several ways:

- Driving wealth inclusion by aligning with the digital mind-set of the growing numbers of new-to-wealth customers

- Offering ‘sticky’ 360 degree view digital customer reporting

- Enabling self-directed investments and insurance

- Providing digital advisory

- Increasing overall wealth management AUM by integrating with Super Apps in terms of payment gateways, fund investments and related financial services

- Driving customer acquisition through a better user experience

- Partnering with the right firms, including digital players, to deliver a complementary service

Some caution among traditional financial institutions which are moving in this direction is to be expected. Complex and siloed legacy IT systems remain a big and expensive hurdle for most players.

In Vietnam, for example, local banks have held back from a push towards full digitalisation. They have opted to bolster existing web-based and mobile platforms first.

However, there has been some initial progress as some players evolve and adapt more quickly to the new digital era.

One example is the partnership between VPBank and VinaCapital, the fund house, to create Timo, the country’s first virtual bank. As the incumbent, VPBank is handling the KYC process and covering any losses that stem from overdrafts. But in return, the bank gets to access a younger set of customers.

In Indonesia, meanwhile, banks have recently started to take clear steps in a digital direction.

Mid-sized Bank Mega, for instance, part of the Indonesian conglomerate CT Corp, wants to allow users to link their bank accounts as well as debit and credit cards to its payment service to facilitate higher-value transactions. It also has an advantage over the Super Apps supermarket via the relationships it has with Transmart and US fast-food chains Wendy’s and Baskin-Robbins — especially since Transmart doesn’t accept Gojek or OVO payments.

In need of help to digitise

Two key groups of financial institutions need to adapt their models to meet the needs and demands of South-east Asia’s mass affluent:

1. Foreign challenger retail banks building up their wealth management business in the region

2. Local incumbent retail banks that have a large existing customer base

Section 4: NEW BUYING HABITS

Inside the mass affluent mind-set

Seven distinct behaviours define the buying habits of the mass affluent in the key growth markets across South-east Asia

Before incumbent banks can effectively adapt their business models, products and services, they first need to understand how the majority of affluent South-east Asians think and act.

Based on a combination of anecdotal evidence, plus the BCG research and the report from Google, Temasek and Bain & Company, some specific consumer behaviours are relevant for bank marketers targeting the mass affluent in this region:

- They embrace ‘premiumisation’– as consumers in this region became ‘middle class’, they purchased products to reflect that status, such as smartphones, cosmetics and plasma TVs. Moving into the affluent class means a further shift as they look to upgrade to more expensive items in the search for premium products.

- They shop online more than ever before — online shopping for the affluent in South-east Asia has moved on from buying big-ticket items such as TVs more cheaply and is now a regular experience.

- They seek quality and value– although affluent South-east Asian consumers no longer fall into the stereotype of ‘showing off’ their wealth or automatically associating a top brand and high price with quality, affluent consumers with more experience of wealth are more discerning and want proof of value and quality, such as wanting to ensure the purchase will retain its value or appreciate.

- They want exclusivity — since the mass affluent in this region view products as a way to ‘stand out’, they prefer to acquire goods or services that are unique or different, such as ‘limited edition’ apparel and boutique brands.

- They relish the ‘experience’– as much as wanting the product itself, many of South-east Asia’s mass affluent like to enjoy the feeling they get when they buy certain premium products or get invited to promotional events. It is important to these consumers that they identify with the brand’s marketing story.

- They use digital media– the role of digital media is crucial in helping mass affluent consumers in South-east Asia make buying decisions. This is particularly the case in certain markets, such as the Philippines, where the BCG research said 88% of respondents had used digital channels relating to a purchase, such as searching for information, buying a product, or posting feedback.

- They travel frequently– the new-to-wealth segment makes, on average, 12 international trips a year, according to BCG. The accompanying increase in travel spending with this move from middle class to affluent status is notable — a Thai household’s average spending per trip, for example, jumps nearly nine-fold.

Section 5: BANKING ON DIGITAL IN SOUTH-EAST ASIA

Making wealth management pay again

Traditional financial institutions need a clear roadmap to drive new digital demand for wealth inclusion across the mass affluent in key South-east Asian markets

There is no doubt about the wealth management opportunity for incumbent banks across Indonesia, the Philippines, Thailand and Vietnam.

There is significant — and growing — scope for them to do more with these customers as they expand in number and wealth, and to do it in new ways.

Working in the favour of the traditional players is also the fact that South-east Asia’s pace of growth in the internet economy has created the potential for them to overcome blockages of the past — they can now more readily access robust and up-to-date data, improve convenience, slash costs and deliver more inclusive financial services for the mass affluent as they emerge and expand.

The ultimate goals for the banks are multi-fold. They include:

- Increasing business volume

- Activating underserved clients

- Broadening sales activity into areas such as life insurance

- Producing at zero marginal costs

There are five key components of success for banks that want to compete in a digital world where they, for the time being, are in the shadow of the Super Apps.

1. Create partnerships and ecosystems

Super Apps have shown how to successfully bring together industry verticals in a virtual world, tied together by the user experience they provide.

Banks need to selectively decide what they want to offer customers — and which partners they want to collaborate with to do that — since they will be judged by the relevance, breadth and value that their ecosystem brings to customers.

2. Develop open data and APIs

Super Apps have been pioneering in building models based on a willingness to share customer data across different service areas and lines of business. This way they get the benefits of a more rounded view of their customers.

Banks need to modernise the way they think about incorporatingapplication program interfaces (APIs) and open data systems. They increasingly need to accept the reality of becoming aggregators of both their own products as well as those from third parties — and, in turn, get access to rich data flows– rather than risk being disintermediated by other aggregators, especially the Super Apps.

3. Enhance data and analytics capabilities

Just having more data is meaningless in isolation — knowing how to segment and interpret this information is a key way that the Super Apps have been able to deliver relevant products and services to customers in an accessible way.

Banks need to unlearn (bad) habits of the past where they have let data sources become disparate. This needs a renewed commitment and increased investment in resources dedicated to data management with enhanced analytics capabilities, if they are serious about competing with the Super Apps.

4. Keep the offering simple

New-to-wealth customers are not always wealthy by traditional measures such as income levels; instead, they might have greater local purchasing power which drives new habits to align these individuals with their new segment. As a result, it is about wealth inclusion (at least initially), so a relatively simple savings, investment and insurance 8Sproposition resonates best.

Banks need to realise that what customers want is transparency and relatively straightforward services. These include teaching them how to invest, providing education and guidance, and giving them the tools to keep track of their finances.

5. Take a gradual, step-by-step approach, deliver fast

Super Apps have shown the effectiveness of incrementally adding new services to their original business model to capture a greater share of a customer’s time and wallet through a single touchpoint.

In a similar way, banks need to use data analytics to identify ways to exploit the intelligence at their disposal and add value to customers through new features and services as part of their offering.

For banks looking to (re)gain market share with the mass affluent across Indonesia, Thailand, the Philippines and Vietnam, it all comes down to giving choice to a customer.

The process for incumbent banks to do this is relatively simple: first define their desired business outcome and then identify the individual feature or service required to support the business in achieving that objective. New services can then be added that is in line with the overall goal.

This might apply to functionality such as:

- 360 degree views on reporting assets and performance to customers

- Cross-selling investment and insurance products to customers

- Automatically rebalancing customer portfolios

According to the report from Google, Temasek and Bain & Company, five financial services are ripe for transformation in the digital era: payments, remittance, lending, investment and insurance.

Source: “e-Conomy SEA 2019 — Swipe up and to the right: Southeast Asia’s $100 billion Internet economy”, Google, Temasek and Bain & Company (October 2019)

In addition to digital payments on track to surpass the US$1 trillion mark by 2025, e-wallets, starting from a small base, are poised to grow even faster. Accounting for just over US$22 billion in 2019, they are likely to grow more than five-fold and to exceed US$114 billion by 2025.

Against this backdrop, the future will inevitably involve some form of power shift between incumbent banks and tech firms that drive the Super Apps. Ultimately, banks will have to cede ground as pioneers of financial innovation in the past but in collaboration with payment gateways, transaction and trading platforms, investment tools and other mobile functionality that enhances the user experience.

The banking model for the new-to-wealth in South-east Asia

Focus on the user experience by offer clients an extended self-service channel, plus:

- Allow detailed and transparent portfolio monitoring anytime and anywhere

- Provide clients with a segment specific and customised offering

- Give clients access to financial markets at affordable prices

- Inform clients with customised alerts and notifications

See original blog: https://medium.com/additiv/winning-the-rebundling-race-in-south-east-asia-42f09f0e3454

You can get in touch with additiv by clicking the 'Connect with additiv' button on their profile.