There is a clear trend toward unity in the Canadian credit union market. As member expectations shift to more tech-enabled seamless experiences, credit unions are finding it more challenging to deliver.

The result has been a fall of 37% in the number of credit unions in the 10 years leading up to late 2022 largely due to consolidation deals. By pooling resources in this way, credit unions will have a better chance of updating their tech capabilities and attracting long-term members.

That said, while technological development is part of credit unions’ strategic roadmap, there is a certain disconnect regarding when the investments should take place. For years, institutions such as CD Howe have been warning that the institutions must embrace digital transformation to thrive and that the time is running out for digitalisation to take place.

Instead, the argument moves to a more granular level, where retail banks and credit unions must decide how and where to focus their efforts to achieve healthy customer acquisition costs while also maximising cross sell or upsell opportunities.

What is stalling digitalisation?

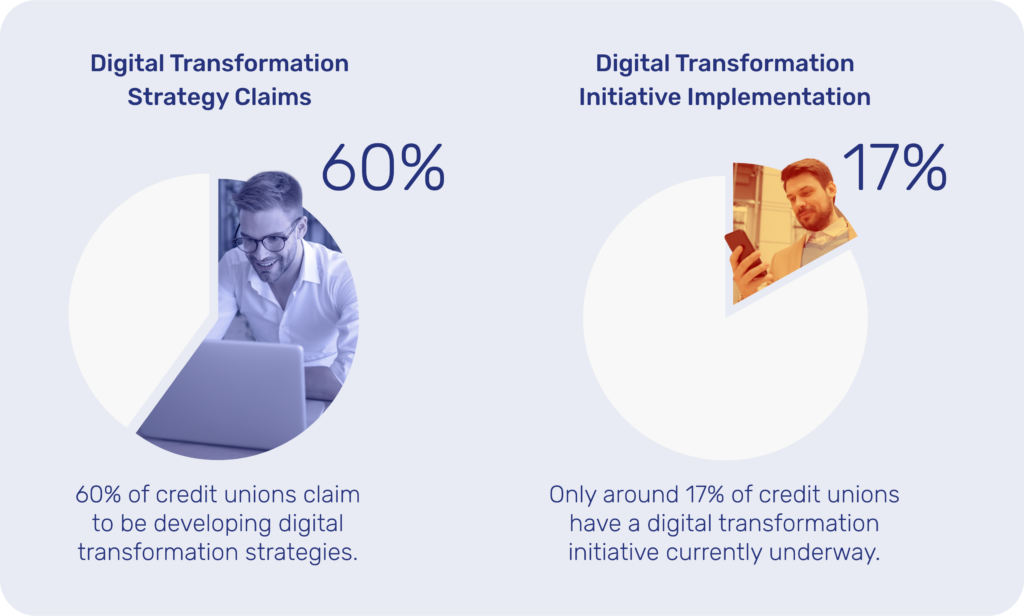

Despite strong recommendations within the financial services industry as a whole to transform, there appears to be some reluctance among the credit union leaders themselves. While 60% of credit unions claim that their organisations are developing digital transformation strategies, a smaller percentage actually have an initiative underway. only around 17% actually have an initiative underway.

There is something of a disconnect here. The understanding of the importance of digital transformation is certainly widespread within the industry – and yet making real, tangible progress appears to be slow or non-existent.

There is no denying that there are many obstacles to incorporating advanced digital solutions that credit unions need to deal with, such as rising IT costs due to inflation or the never-ending battle regarding cybersecurity and data privacy risks.

However, these obstacles are also present in other financial institutions, which in general have more mature digital initiatives. So, what is different?

Waiting for tomorrow to come

According to a KPMG insights article, the issue that credit unions have “is scale; smaller organisations have less investment capital to make big changes.” This is not only nothing new but it actually takes us full circle to the original trend – that of ongoing credit union consolidation.

The crux of the issue, however, is that many credit unions are weary of actually making substantial technology updates until their consolidation initiatives are more mature. In other words, they want to feel like they are on firmer footing before taking the next step.

Striving for digital maturity

While the temptation to wait is understandable, it does come with certain risks, most notably a delay in reaching digital maturity quickly enough once the consolidation has taken place.

The concept of digital maturity is nothing new. Any new initiative will involve short-term wins, long-term wins, and a strategic roadmap to define goals and performance over time. The complications arise when you try to determine an organisation’s level of digital maturity.

It is important to note that digital maturity is not just about the technology implemented in the organisation, but the “skills, mindset and attitudes of the business leadership.” In fact, the implementation of robust digital capabilities is just the first step in achieving the required level.

The journey never ends

In real terms, digital maturity is elusive and never ending, with businesses from all sectors always having to reevaluate their plans and adjust to maintain pace with customer preferences and competing institutions. The Deloitte Digital Maturity Index, for example, is based around 90 different operational and strategic parameters to assess maturity level. According to their most recent global report on digital maturity, the organisations in all regions placed a strong emphasis on increasing the speed of digitalisation.

For credit unions – which compete with financial institutions that have embraced digitalisation and online banking – waiting until any ongoing consolidation process has taken place before turning their attention to transformation initiatives this poses a huge challenge. Once they decide to implement new technology, they are too far behind to be able to compete for potentially years afterwards.

Digital transformation is your ally

While digital maturity cannot be forced, there are strategic approaches that credit unions can take to hit the ground running when the consolidation phase comes to an end. To illustrate this, we will focus on the most pressing aspect of digital transformation in a member service context – conversational engagement.

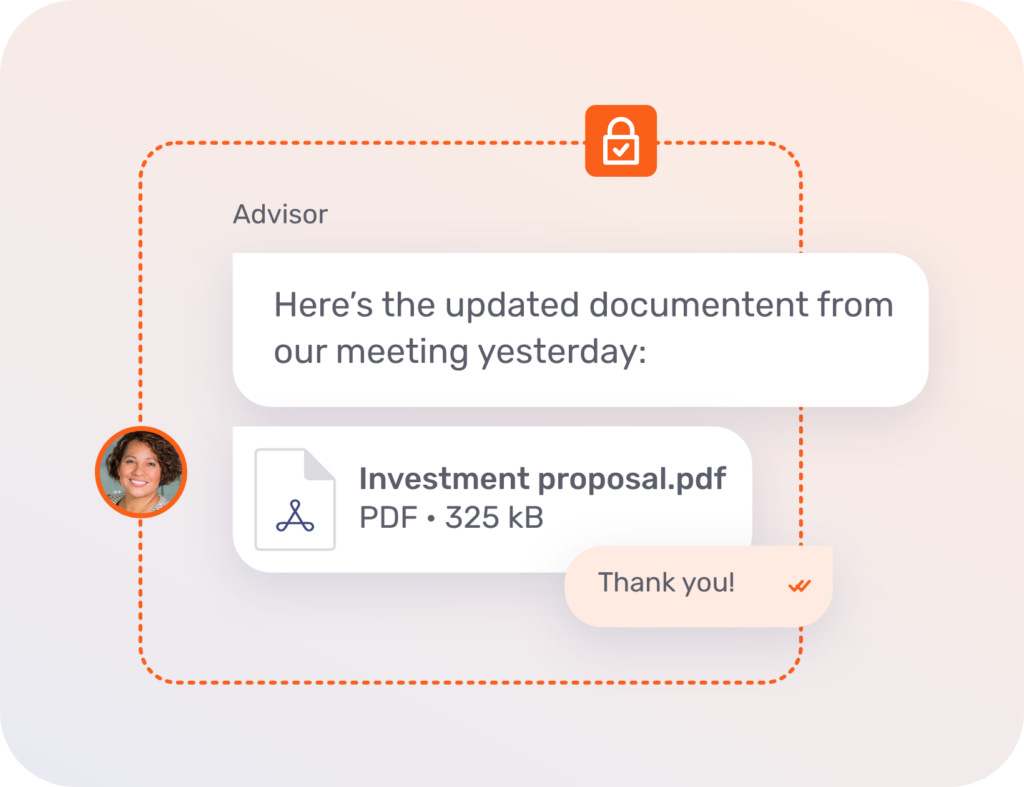

Conversational engagement is an ongoing process that involves delivering on expectations to achieve deeper member engagement throughout each individual journey, across a wide range of touchpoints. Members nowadays expect to be able to talk to their credit union on the channel of their choice and have access to the right self-service tool or agent depending on their specific needs.

Achieving this requires implementing a Conversational Engagement Platform like Unblu, which can triple financial institutions’ conversion rates. Directly out of the box, tools such as the Conversational Artificial Intelligence (AI) chatbot can field up to 70% of incoming queries.

That said, an organisation looking to leverage conversational engagement will still need time to train the credit union employees, get used to the technology, and develop internal processes.

Conversational engagement for CU consolidation

A financial institution was in a similar situation to many Canadian credit unions, where they were undergoing a user migration process. What is more, the institution understood the strong need to continue offering a super digital experience.

To achieve both aims, the institution decided to implement Unblu’s platform and gain access to a several key features:

Live Chat

A messaging channel that can be accessed on websites or via authenticated areas, such as portals or apps.

Video & Voice Calls

A secure, high-quality call experience that can be launched from a number of channels – including Live Chat – and has a number of in-call features.

Co-Browsing

This is the ultimate in remote collaboration, allowing credit union employees and members to interact with documents, web pages, or more in a secure, collaborative manner.

Assisting with the migration

By using these features, the financial institution’s migration process went smoothly. Alongside having access to better internal communication features, they were able to deflect incoming requests from just the phone lines to more appropriate channels.

Beyond this, the tools helped with the onboarding process to ensure trust was built at a delicate moment in the relationship, even while substantial changes were taking place.

This approach of leveraging new technology – which can also include Conversational AI to good effect – during a period of substantial change led to some surprising results:

Average Handle Time

The institution expected their AHT to take a hit due to complications associated with the migration process. However, with Unblu’s tools, they managed to achieve 80% better than the projected AHT.

Co-Browsing in key moments

A total of 15% of the phone calls used embedded Co-Browsing in key moments to facilitate a smooth transition period to maintain levels of customer service and trust.

Satisfaction scores

Overall, users reported an average satisfaction rating of 4.7 out of 5 after a co-Browsing session – showing that customer perception was not harmed despite the disruption.

Most importantly, once the migration was finalised, the financial institution was fully set up with digital tools to offer their customers more engaging and frictionless experiences.

Do not delay your credit union’s digitalisation initiative

The consolidation efforts underway are providing credit unions with an opportunity to attract and retain a new wave of members with personalised services. However, by delaying investments in new technologies until the initiatives are complete, CUs risk digital immaturity at a critical moment in their strategic development. This will inevitably have a knock-on effect on individual financial relationships or even the entire credit union industry as a whole.

Read the full article here.