Investors frequently exhibit the tendency to build or buy models/data sets that they believe can predict price action, but our assertion is that this is a false dream unsupported by facts. However, Trend capture is pragmatic, agnostic, and even cynical, that implies security selection via Trend analysis is opportunistic and bias-free.

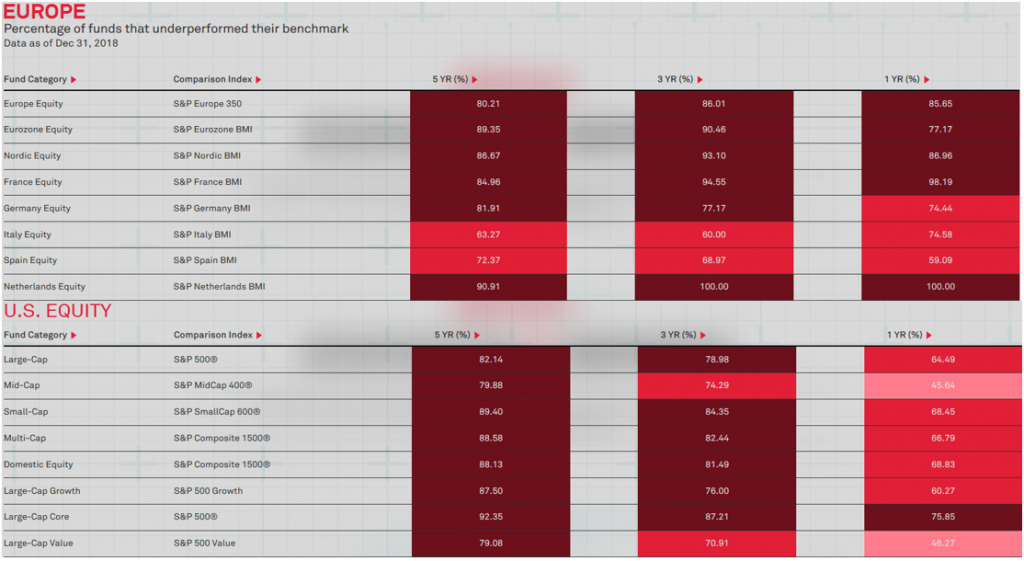

The focus on predictive data sets stems from the belief that a strong historical infers a predictive relationship with future price trends. The majority of active investment management workflows are built on analysis of fundamental data whose historical correlation with price trends no longer holds true for future price trends. SPIVA1 has published several studies that are highlighting the poor performance of active managers, with over 80% underperforming their benchmarks on a 5-year basis both in Europe and USA; the full scorecard is available in Appendix I.

Recently sentiment data and big data have been the source of a fair amount of hype but factual proof of the predictive value of these data sets has yet to be proven. Sentiment data lacks the ability to predict the length and magnitude of a future price trend whilst there is lack of documented proof of big data analysis successfully determining future price action.

Therefore in the absence of a clear cut evidence of the predictive value of any of the predictive frameworks, be it old school fundamentals to sentiment analysis or big data analysis, it is Trendrating’s assertion that the best course of action is to go straight to the core i.e. measure the trend itself. This requires trend capture whereby one captures the direction, quality, and magnitude of the trend at the security level in order to separate the winners from the losers, in order to deliver superior and consistent performance.

Trend capture offers investment managers a framework for outperforming their benchmarks and to prove that active management can be smarter than benchmark tracking passive strategies. It does require acceptance by active managers that there exists a problem within the investment processes, and adopting validated advanced analytics based on trend capture is an opportunity that they cannot really afford to ignore any longer.

Trend analytics are an easy to overlay onto any investment process, and offer a repeatable workflow for the timely identification of winners and losers within any investment universe. The resistance to the adoption of the latest developments of intelligent, sophisticated trend evaluation virtually guarantees the continued underperformance for the majority of active managers.

The good news is that the accuracy of trend analytics can be measured and tracked. The correlation of this dataset to subsequent price action can be tested and observed in real time. This is the opportunity for smart active managers to begin delivering benchmark relative outperformance and start to fightback against passive strategies.

By Arun Soni, Global Head of Strategy at Trendrating

APPENDIX I

See original blog: https://www.trendrating.com/2019/09/27/accurate-trend-capture-framework-vs-inaccurate-predictive-modelling/