With global equity markets recording a plunge of more than 10% during the week of 24 February 2020, the economic impact of the coronavirus will likely leave lasting damages for a number of equity sectors in its wake. However, other more resilient sectors may hold-up relatively well as they weather out the storm. To avoid potentially harmful pitfalls, tracking the performance dispersion across stocks and sectors can provide a means for investors to navigate through the tempest.

At Trendrating, we support a timely and objective comparison of trends across stocks and sectors via our proven proprietary rating methodology. In light of the volatile and rapidly developing global market conditions, we believe investors might want to consider limiting portfolio exposure only to those sectors, where the majority of stocks are healthy and strong (sector rating at “B” or above). A “B” rating or higher identifies sectors where 60% or more of the stocks are trending up. Conversely, we view sectors with a weak overall rating (sector rating at “B-” or below) as potentially less favourable.

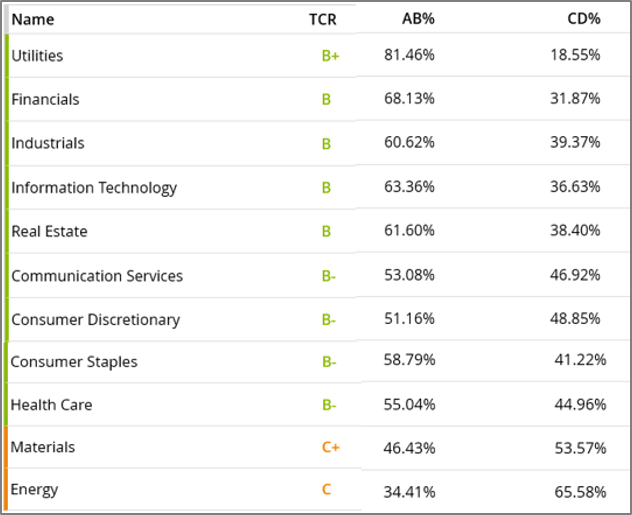

Developed Markets – Americas

Taking a closer look at the US equity market, utilities exhibit a rating of “B+“, with 81% of stocks in a bull trend. Apart from utilities, there are four other sectors − financials, industrials, information technology and real estate − that are rated “B“, containing above 60% of stocks that are trending up.

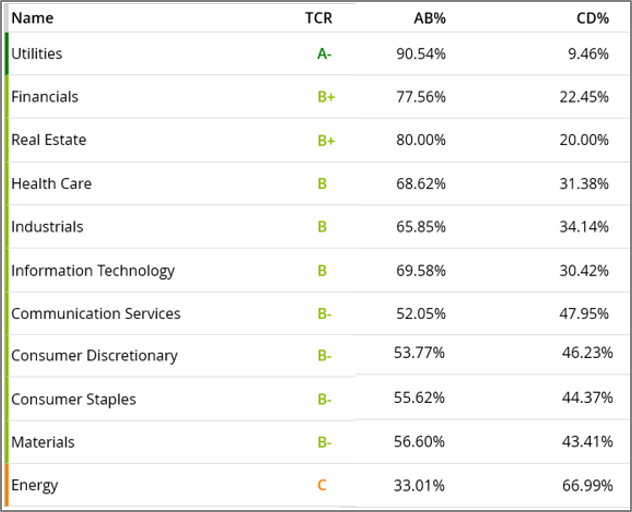

Developed Markets – Europe & Middle East

Across EMEA, utilities have the highest rating with an “A-” recording, with 90% of stocks in a bull trend. Two sectors − financials and real estate − are rated “B+“, with more than 77% of stocks trending up. While three other sectors (health care, industrials and information technology) have a “B” rating, with 60% or more of stocks moving up.

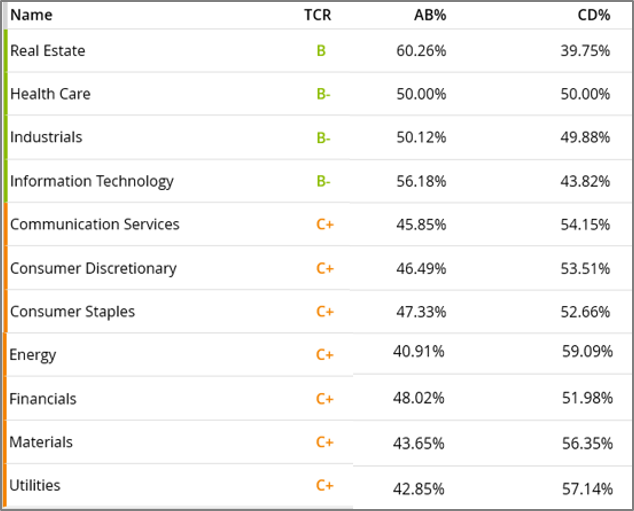

Developed Markets – Asia Pacific

In Asia Pacific, only the real estate sector is rated “B“, while all the other sectors display a poor rating, confirming the overall weakness of the region.

Investors can use Trendrating’s proprietary rating methodology to identify and to select the best stocks (rated “A“) in the strongest sectors (rated “B” and above) to capture opportunities, while avoid exposure to weak sectors, or at least limit their exposure.

See original blog: https://www.trendrating.com/2020/03/02/a-selective-navigation-through-risks-and-opportunities/